I have 3 points but so does he, for the same reason. So the question still remains, how does his differ so much to mine. Anyway, im gonna see what happens next year

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Confusion - insurance prices

- Thread starter AgnessGP

- Start date

Currently reading:

Confusion - insurance prices

have you been a naughty boy in the past ; they check with the dvla you know ,if not search car mags they advertise specialist companies for the young who want to drive fast cars.

Not at new business, or renewal, they don't.

Done another quote with admiral.

Car: clio 182

NCb:2 years

Car kept in: garage

Points: 3

Accident not at fault: 1

Age: 20

Named drivers: none

Main driver: me

Cover: third party

The quote

Me: £10,981

Mate: £1700

I don't know what or how it can differ so much. Something is seriously weird here

Car: clio 182

NCb:2 years

Car kept in: garage

Points: 3

Accident not at fault: 1

Age: 20

Named drivers: none

Main driver: me

Cover: third party

The quote

Me: £10,981

Mate: £1700

I don't know what or how it can differ so much. Something is seriously weird here

Done at different addresses?Done another quote with admiral.

Car: clio 182

NCb:2 years

Car kept in: garage

Points: 3

Accident not at fault: 1

Age: 20

Named drivers: none

Main driver: me

Cover: third party

The quote

Me: £10,981

Mate: £1700

I don't know what or how it can differ so much. Something is seriously weird here

yep, literally a 1 minute walk apart

yep, literally a 1 minute walk apart

That could be part of the reason. Postcode ratings really are that accurate depending upon different companies.

Yeah I understand...but seriously, would that cause that much of a difference? I admit, where I live is a much higher risk to him, despite being 2 secs away, but really...£9k different?

I know the online quote often differs from a chat with the company, but for example, other friends nearby with even less driving experience are getting £2800 lowest cost.

I know circumstances vary so much, but to the tune of 9k?

I know the online quote often differs from a chat with the company, but for example, other friends nearby with even less driving experience are getting £2800 lowest cost.

I know circumstances vary so much, but to the tune of 9k?

Last edited:

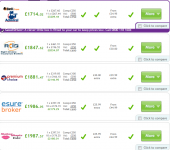

Well the time has come again. Renewal.

Adrian flux who im with at the minute, have offered £760 third party only with no option of going fully comp until im 21 (august).

Admiral have offered £790 fully comp (no mods though).

Decisions!

What's more is that I can't afford a one off payment so it looks like its gona be £98 per month whichever I choose, at a cost of £1100 Damn!

Damn!

Adrian flux who im with at the minute, have offered £760 third party only with no option of going fully comp until im 21 (august).

Admiral have offered £790 fully comp (no mods though).

Decisions!

What's more is that I can't afford a one off payment so it looks like its gona be £98 per month whichever I choose, at a cost of £1100

Sam its cheaper to keep your car

On the road

On the road

Re: Re: Confusion - insurance prices

Can you put an older driver on as a named driver ideally one with a clean licence i have my dad on mine (he does use the car occasionally eg drives my car onto the road to get his off the drive or to the shops or use it in the snow as it will drive unlike his that won't move with the Continentals along with fetch me home from the pub) and it used to save me a good few quid not so sure now but its worth a try

Nb im the main driver not been fronted

Well the time has come again. Renewal.

Adrian flux who im with at the minute, have offered £760 third party only with no option of going fully comp until im 21 (august).

Admiral have offered £790 fully comp (no mods though).

Decisions!

What's more is that I can't afford a one off payment so it looks like its gona be £98 per month whichever I choose, at a cost of £1100Damn!

Can you put an older driver on as a named driver ideally one with a clean licence i have my dad on mine (he does use the car occasionally eg drives my car onto the road to get his off the drive or to the shops or use it in the snow as it will drive unlike his that won't move with the Continentals along with fetch me home from the pub) and it used to save me a good few quid not so sure now but its worth a try

Nb im the main driver not been fronted

Last edited:

Can you put an older driver on as a named driver ideally one with a clean licence i have my dad on mine (he does use the car occasionally eg drives my car onto the road to get his off the drive or to the shops or use it in the snow as it will drive unlike his that won't move with the continue along with fetch me home from the pub) and it used to save me a good few quid not so sure now but its worth a try

Nb im the main driver not been fronted

Defo worth doing what Andy has said

Don't forget to declare mods though.

Not sure if you'd be able to, but might work out cheaper to get a credit card to pay for that on if you're able to get one with a high enough limit.

@Reuuk no idea what you mean mate? As opposed to car park you mean?

@andymonty (tagging fails when there is a name found shorter than the full name) tried it! Puts it up! Has always been the case with my insurance.

@Most Easterly Pandas I have a credit card with NatWest which I use regular but I wouldn't like to stick that much at once...unless they let me pay in 2 or 3 instalments, like Adrian did. But then again, that means being worse off for 2 or 3 months.

The monthly option sounds good as it allows me not to be skinted, but the extra £££ isn't appealing. Can't decide!

Also, bell wanted £300 for springs of 20mm in 2011. Bet admiral are the same?

@andymonty (tagging fails when there is a name found shorter than the full name) tried it! Puts it up! Has always been the case with my insurance.

@Most Easterly Pandas I have a credit card with NatWest which I use regular but I wouldn't like to stick that much at once...unless they let me pay in 2 or 3 instalments, like Adrian did. But then again, that means being worse off for 2 or 3 months.

The monthly option sounds good as it allows me not to be skinted, but the extra £££ isn't appealing. Can't decide!

Also, bell wanted £300 for springs of 20mm in 2011. Bet admiral are the same?

Last edited:

Reuuk no idea what you mean mate? As opposed to car park you mean?

Insurers will insure you car usually for a cheaper price if it is on the road. I ask why this was and basically if the car is on your 'drive' or 'garage' they gaining access to your property and therefore they would have to liason with your home insurance (if covered in garage) as a house theft. So for example with my insurance, its £25 pounds cheaper for me to insure the car as 'parked on the street' as asposed to my drive way

Change it on your quote details see if it makes a difference

it is actually parked on the street but I have always said public car park, suppose its the same thing? Or is that blatent lying lol

Just say its parked on street

good idea!! cheers!

Most Easterly Pandas would a 0% interest card work? if I can find one that is? Then I can make my own monthly payments to it.

Most Easterly Pandas would a 0% interest card work? if I can find one that is? Then I can make my own monthly payments to it.

Insurers will insure you car usually for a cheaper price if it is on the road. I ask why this was and basically if the car is on your 'drive' or 'garage' they gaining access to your property and therefore they would have to liason with your home insurance (if covered in garage) as a house theft.

Sorry to say that whoever told you that was speaking coblers. Some companies may charge a higher premium if they have more claims for cars parked on a drive than street in a certain postcode area, but that won't be the same for every insurance company.

And regarding car theft from a garage, there would be no liaison as home and car insurance cover wouldn't cross in that event. You'd claim for car off car insurance and any building damage off of home insurance, would be treated as two separate claims.

Regarding theft from drive, home insurance wouldn't even need to be advised.

I have a credit card with NatWest which I use regular but I wouldn't like to stick that much at once...unless they let me pay in 2 or 3 instalments, like Adrian did. But then again, that means being worse off for 2 or 3 months.

Spread it over 12 months, your APR is probably lower on credit card and the insurance companies credit agreement.

would a 0% interest card work? if I can find one that is? Then I can make my own monthly payments to it.

Can't see why not.

Sorry to say that whoever told you that was speaking coblers. Some companies may charge a higher premium if they have more claims for cars parked on a drive than street in a certain postcode area, but that won't be the same for every insurance company.

And regarding car theft from a garage, there would be no liaison as home and car insurance cover wouldn't cross in that event. You'd claim for car off car insurance and any building damage off of home insurance, would be treated as two separate claims.

Regarding theft from drive, home insurance wouldn't even need to be advised.

Spread it over 12 months, your APR is probably lower on credit card and the insurance companies credit agreement.

Can't see why not.

That's fine mate, I'm just going off what I've seen on price differences with regards to my insurance and what I've been told. 8/10 people I know who have checked the price difference between the street and garage\drive has found it's been cheaper for them too...

8/10 people I know who have checked the price difference between the street and garage\drive has found it's been cheaper for them too...

Not denying that, just the stuff you was told as the reasoning

Similar threads

- Replies

- 9

- Views

- 1K